Table of Contents

ToggleCDP for Banks: Empowering Financial Institutions to Engage Customers Deeply and Profitably!

Summary

- Implementing a Customer Data Platform (CDP) in the banking sector requires a structured, top-down approach.

- Breaking down data silos and integrating online and offline data sources are key to a seamless onboarding process.

- A robust CDP is essential for transitioning from outdated legacy systems to a modern, omnichannel banking experience.

Every day, banks generate vast amounts of customer data across various touchpoints—structured and unstructured, static and dynamic. With the right CDP, banks can centralize this data, drawing insights from internal and external sources to deliver highly personalized and results-driven customer engagement.

Breaking Down Data Silos for a Unified Customer View

Today’s customers expect tailored experiences, influenced by digital-first businesses. However, strict regulations and data protection laws in banking make personalization complex. A well-implemented CDP ensures secure financial data management while maintaining compliance with privacy norms and security standards. Unlike conventional data management tools, a CDP allows banks to safeguard personally identifiable information (PII) while leveraging encryption techniques to integrate data seamlessly across multiple platforms.

By consolidating demographic, behavioral, and transactional data, a CDP creates a holistic customer profile that updates in real time with each customer interaction. This empowers bank marketers to craft highly targeted, relevant campaigns at an individual level.

Use Case: Merging Online and Offline Data Sources for a Comprehensive View

Leveraging Data for Personalized Customer Experiences

An advanced CDP grants banks a unified perspective on customer data, enabling real-time personalization, precise decision-making, and predictive content recommendations. With a single customer profile at their fingertips, banks can tailor communications to resonate with each individual’s preferences and behaviors.

The depth of personalization hinges on the quality of data. While tracking online behaviors is a foundational step, integrating offline data—such as in-branch visits and ATM transactions—enriches the customer experience significantly.

Additionally, a CDP enhances marketing efficiency by granting direct access to rich customer insights, reducing dependence on IT and analytics teams for data-driven decision-making.

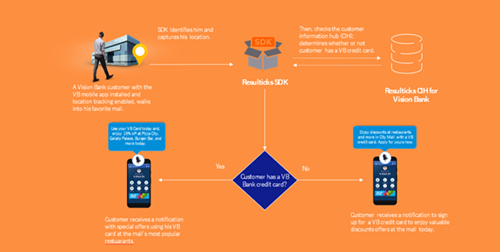

Use Case: Location-Based Offers to Improve Customer Engagement

Actionable Insights and Predictive Analytics

A well-structured CDP doesn’t just provide insights into past customer behaviors—it also detects shifts in preferences through real-time interaction analysis.

Given the extensive data banks collect, a CDP powered by AI-driven predictive and prescriptive analytics can extract critical insights. For example, machine learning algorithms can predict:

- Customers at risk of churning.

- Clients likely to adopt new banking products.

- Users considering competitors’ offerings.

- Loan applicants’ repayment capacity based on credit scores and behavioral trends.

- Strategies to mitigate potential loan defaults.

Use Case: AI-Driven Lookalike Targeting for Smarter Marketing Campaigns

Real-Time Data Processing for Proactive Engagement

CDPs process data in real time, keeping marketing strategies agile and data relevant. After ingesting customer data, the system cleans, standardizes, and segments it, ensuring seamless activation across various marketing channels.

By maintaining up-to-date customer profiles with evolving demographic data—such as updated phone numbers and addresses—a CDP ensures consistent and accurate data across all banking systems in real time.

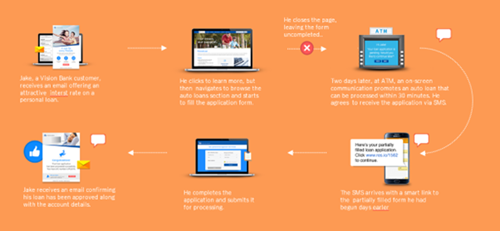

Use Case: Real-Time Loan Application Assistance

Choosing the Right CDP Solution

Banks face a growing challenge in managing increasing volumes of customer data across multiple systems, including legacy infrastructures and newer SaaS platforms. Without proper integration, these fragmented systems create inefficiencies and limit personalization potential.

An effective CDP addresses these challenges by breaking data silos and streamlining data management. When evaluating a CDP, banks should consider:

- Long-term and short-term use cases.

- Scalability and adaptability to evolving banking needs.

- Integration with existing and future banking systems.

Qilinsa: A Comprehensive Solution for Banking CDPs

Qilinsa provides a powerful and secure CDP solution tailored for financial institutions. With expertise in AI-driven analytics, seamless data integration, and robust security, Qilinsa enables banks to maximize their customer data potential. From unifying disparate data sources to delivering hyper-personalized experiences and leveraging predictive insights, Qilinsa equips banks with the tools they need to enhance customer engagement and profitability.

🚀 Discover how Qilinsa has helped financial institutions achieve remarkable results. Contact us today to explore customized solutions for your bank.